Rutgers Term Bill Due Date: Everything You Need To Know

Are you stressing about the Rutgers term bill due date? Trust me, you're not alone. Every semester, thousands of students and parents find themselves scrambling to figure out payment deadlines, financial aid, and tuition costs. But don’t panic just yet—this guide has got your back. We'll break down everything you need to know about Rutgers term bill due dates, payment options, and how to avoid last-minute headaches.

Let’s face it—college tuition is no joke. It’s one of those things that can make your stomach churn, especially when deadlines start creeping up on you. But here's the deal: if you stay organized and plan ahead, paying your Rutgers term bill doesn’t have to feel like pulling teeth. In this article, we’ll walk you through all the important details so you can breathe easy and focus on what really matters—your education.

Whether you're a first-year student or a senior wrapping up your final year, understanding the Rutgers term bill due date is crucial. From navigating financial aid to setting up payment plans, we’ve got all the info you need to stay on top of things. So grab a cup of coffee, sit back, and let’s dive in!

- Understanding Downs Syndrome Memes Humor With Heart And Awareness

- Military Height Weight Standards Your Ultimate Guide To Meeting The Mark

Understanding the Rutgers Term Bill Due Date

First things first—what exactly is the Rutgers term bill due date? Simply put, it’s the deadline by which you need to pay your tuition and fees for the upcoming semester. Missing this date can lead to some serious consequences, like having your classes dropped or being hit with late fees. Nobody wants that, right?

Here's the kicker: the due date isn't always the same every semester. Rutgers typically releases the due dates for each term well in advance, so it’s super important to keep an eye on your email and the official Rutgers website. Bookmark it now—you’ll thank me later.

And hey, don’t forget about the grace period. Sometimes Rutgers offers a short window after the due date where you can still make your payment without penalties. But don’t rely on that too much—it’s always better to pay on time.

- Who Was Gus Fring In Chile Unveiling The Elusive Drug Lord

- D Train Coney Island Stops Your Ultimate Guide To Exploring The Vibrant Boardwalk

Why the Due Date Matters

So, why does the Rutgers term bill due date matter so much? Well, for starters, it’s the key to keeping your spot in classes. If you don’t pay by the deadline, you might lose your enrollment. And let’s be real—finding space in popular classes can be harder than landing a front-row seat at a concert.

Plus, there’s the whole financial side of things. Late payments can mess with your credit score and even affect your ability to get financial aid in the future. Nobody wants that kind of headache. Staying on top of the due date keeps everything running smoothly.

How to Find Your Rutgers Term Bill Due Date

Now that you know why the due date is important, let’s talk about how to find it. The easiest way is to log into your Rutgers NetID account and check your billing statement. It’s usually updated a few weeks before the start of each semester.

Another great resource is the Rutgers Student Accounting Services website. They post all the important dates for tuition payments, so it’s worth checking out regularly. Bookmark it, print it out, stick it on your fridge—whatever works for you!

Pro tip: Set up calendar reminders for the due date and any other important financial deadlines. Trust me, your future self will thank you.

Common Mistakes to Avoid

Here are a few mistakes students often make when it comes to the Rutgers term bill due date:

- Not checking the due date early enough

- Forgetting to factor in financial aid or scholarships

- Waiting until the last minute to make a payment

- Ignoring grace periods or late payment options

Don’t let these slip-ups trip you up. Stay organized and proactive, and you’ll be golden.

Financial Aid and Scholarships

Let’s talk about the elephant in the room—money. Many students rely on financial aid and scholarships to help cover their Rutgers term bill. But here’s the thing: you need to apply early and often to make sure you’re maximizing your aid.

Check out the Rutgers Office of Financial Aid website for all the info on grants, loans, and scholarships. And don’t forget to submit your FAFSA every year—it’s the first step to accessing federal aid.

Tips for Maximizing Financial Aid

Here are a few tips to help you get the most out of your financial aid:

- Apply early for scholarships and grants

- Keep track of deadlines for aid applications

- Communicate with the financial aid office if you have questions

- Review your aid package carefully to understand what’s covered

Remember, financial aid isn’t just a one-time thing—it’s an ongoing process. Stay on top of it, and you’ll save yourself a ton of stress down the road.

Payment Options for Rutgers Term Bill

Paying your Rutgers term bill doesn’t have to be a one-size-fits-all experience. There are several options available to help you manage your payments:

- Payment Plans: Rutgers offers installment plans that let you spread out your payments over several months.

- Online Payments: You can pay your bill directly through your Rutgers NetID account using a credit or debit card.

- Checks or Money Orders: If you prefer the old-school method, you can mail in a check or money order.

- Third-Party Payments: Parents or guardians can also make payments on your behalf.

Whatever option you choose, just make sure you stick to it. Consistency is key when it comes to staying on top of your finances.

Setting Up a Payment Plan

Payment plans are a lifesaver for many students. Here’s how to set one up:

- Log into your Rutgers NetID account

- Go to the Student Accounting Services section

- Select the payment plan option

- Follow the prompts to enroll in a plan that works for you

It’s that simple. And the best part? Payment plans can help you avoid late fees and keep your budget in check.

What Happens If You Miss the Due Date?

Okay, so what happens if life gets in the way and you miss the Rutgers term bill due date? Don’t panic—yet. Here’s what you need to know:

- You might incur late fees

- Your classes could be dropped

- Your academic progress could be affected

But here’s the good news: Rutgers offers a few options for getting back on track. You can contact the Student Accounting Services office to discuss your situation and see if there’s a way to resolve it.

How to Avoid Missing the Due Date

Here are a few strategies to help you avoid missing the Rutgers term bill due date:

- Set up automatic reminders

- Plan your payments in advance

- Communicate with the financial aid office if you’re struggling

- Stay organized and keep track of all your deadlines

A little planning goes a long way. Trust me, it’s worth the effort.

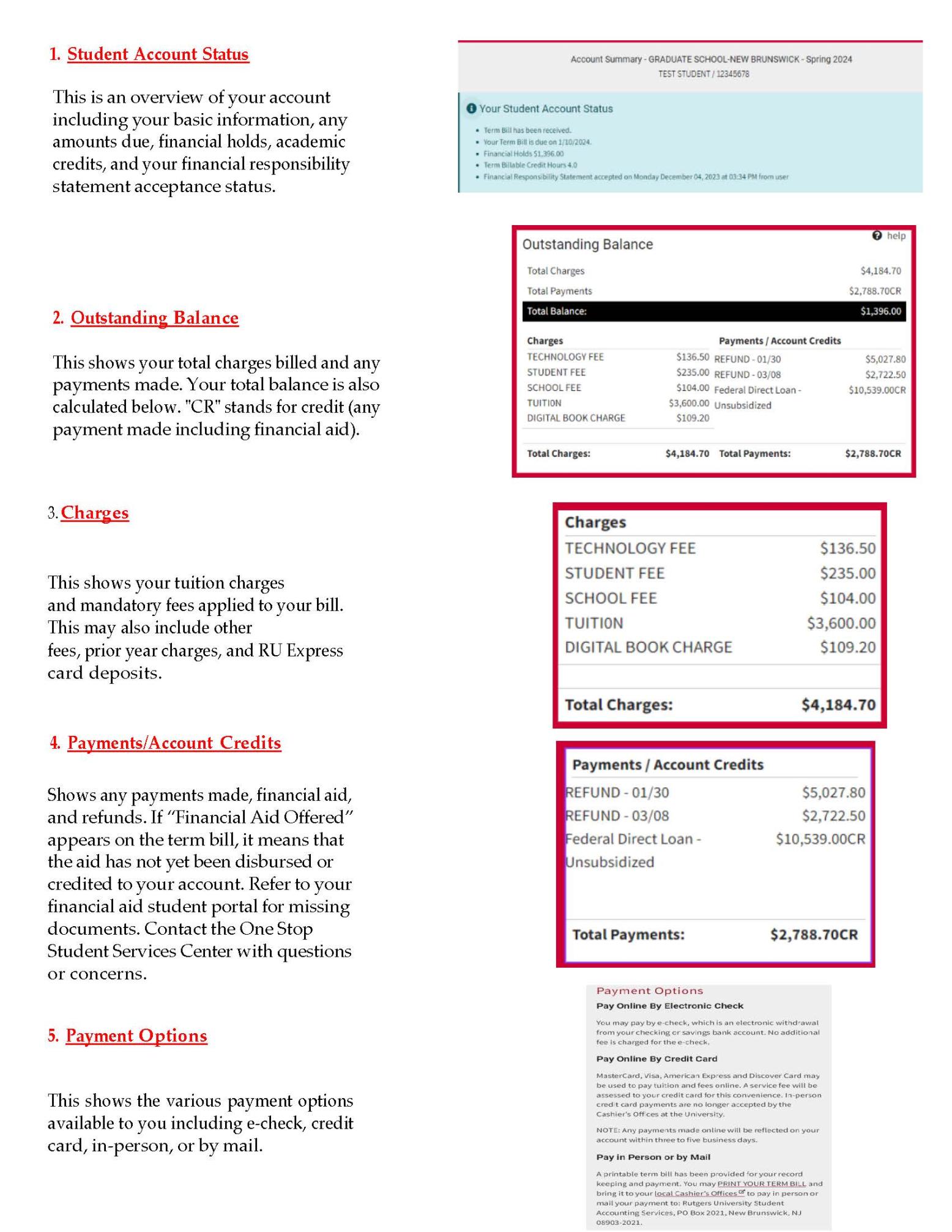

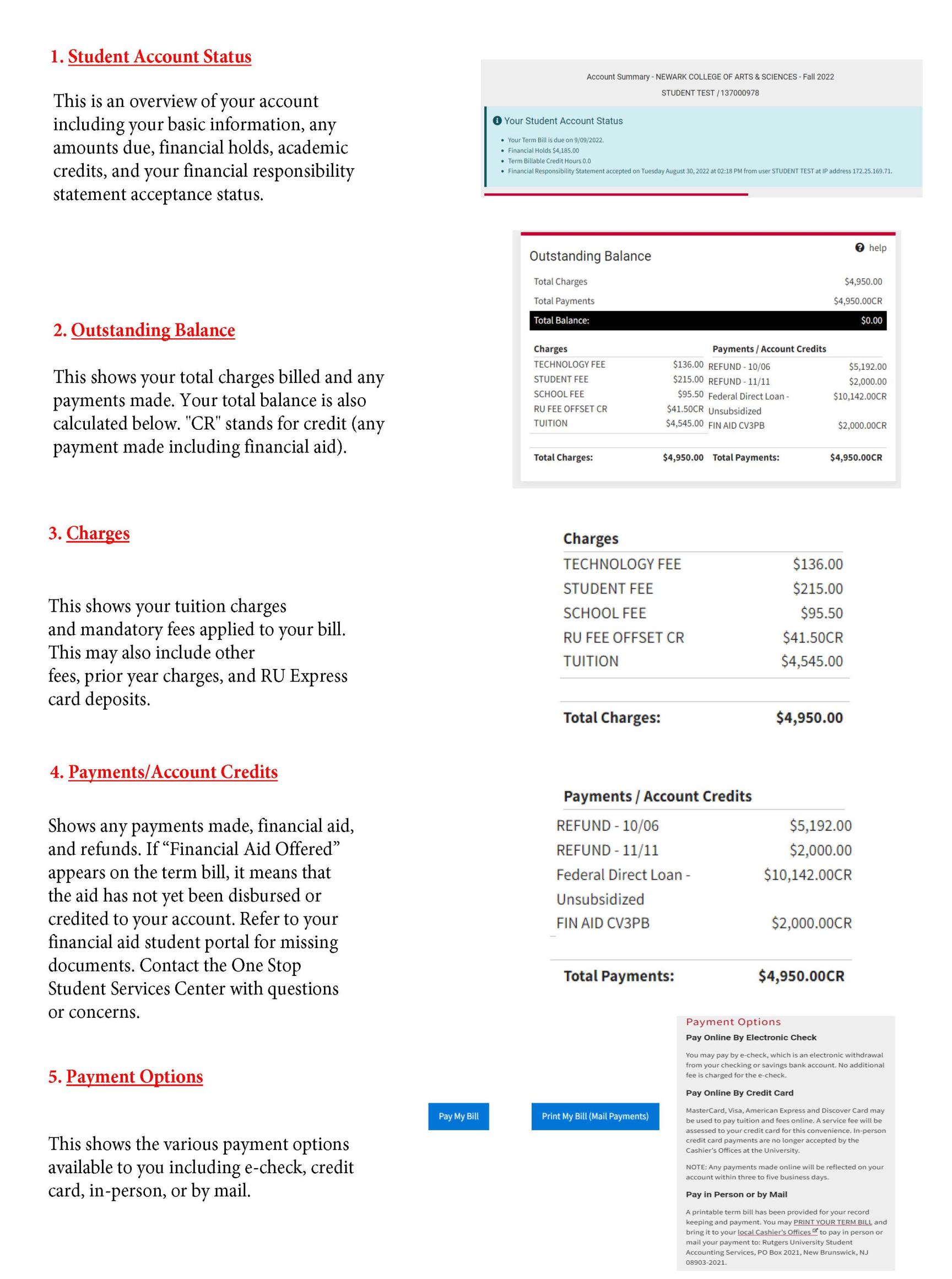

Understanding Your Billing Statement

Your Rutgers billing statement is like a roadmap for your finances. It breaks down all the costs associated with your term bill, including tuition, fees, and housing. But let’s be real—it can be a little overwhelming at first.

Here’s a quick breakdown of what you’ll see on your statement:

- Tuition charges

- Room and board fees

- Meal plan costs

- Financial aid and scholarships applied

Take some time to review your statement carefully. If anything looks off, reach out to the Student Accounting Services office right away.

Common Questions About Billing Statements

Here are a few common questions students have about their Rutgers billing statements:

- Why is my tuition so high this semester?

- How do I apply financial aid to my bill?

- What happens if I change my meal plan?

Don’t hesitate to ask questions. The more you know, the better equipped you’ll be to handle your finances.

Resources for Managing Your Finances

Rutgers offers a ton of resources to help you manage your finances. From budgeting tools to financial counseling, there’s something for everyone. Here are a few resources to check out:

- Rutgers Financial Literacy Program

- Student Accounting Services

- Office of Financial Aid

- Campus financial advisors

These resources are here to help you succeed—not just academically, but financially too. Take advantage of them!

How to Get the Most Out of These Resources

Here’s how to make the most out of Rutgers’ financial resources:

- Attend workshops and seminars

- Meet with financial advisors regularly

- Use online tools and calculators

- Stay informed about financial aid opportunities

Knowledge is power, and these resources can help you take control of your financial future.

Conclusion

So there you have it—everything you need to know about the Rutgers term bill due date. From understanding the due date to navigating financial aid and payment options, staying on top of your finances is key to a stress-free college experience.

Remember, the Rutgers term bill due date doesn’t have to be a source of anxiety. With a little planning and organization, you can tackle it like a pro. And don’t forget to lean on the resources available to you—you’re not in this alone.

Got questions or thoughts? Drop a comment below or share this article with a friend who could use the info. Together, let’s make college a little less stressful and a lot more manageable!

Table of Contents

- Rutgers Term Bill Due Date: Everything You Need to Know

- Understanding the Rutgers Term Bill Due Date

- Why the Due Date Matters

- How to Find Your Rutgers Term Bill Due Date

- Common Mistakes to Avoid

- Financial Aid and Scholarships

- Tips for Maximizing Financial Aid

- Payment Options for Rutgers Term Bill

- Setting Up a Payment Plan

- What Happens If You Miss the Due Date?

- How to Avoid Missing the Due Date

- Understanding Your Billing Statement

- Common Questions About Billing Statements

- Resources for Managing Your Finances

- How to Get the Most Out of These Resources

- Conclusion

- Who Won Cnn Unveiling The Untold Story Behind The Media Giants Triumphs

- What Is The Least Popular Sport Discovering The Underdog Of The Sports World

Understanding Your Term Bill University Finance and Administration

Term Bill help r/rutgers

Understanding Your Term Bill University Finance and Administration