Dallas Property Taxes: A Comprehensive Guide To Understanding Your City's Financial Burden

Let's talk about property taxes in Dallas, Texas. If you're a homeowner in the city, this is one topic you can't afford to ignore. Property taxes are a significant part of your financial responsibilities, and understanding how they work can save you a lot of headaches down the road. So, grab a cup of coffee, and let's dive into the nitty-gritty of Dallas property taxes.

Now, I know what you're thinking. Taxes? Really? But hear me out. This isn't just about numbers and percentages. It's about your home, your investment, and your future. Whether you're a first-time homeowner or a seasoned property owner, knowing the ins and outs of Dallas property taxes can make a world of difference.

So, why should you care? Because these taxes directly affect your wallet. They fund essential services like schools, roads, and public safety. And if you're not careful, you might end up paying more than you should. Stick around, and I'll break it all down for you.

- Mrs Rachel And Dylan The Love Story That Captured Hearts Worldwide

- How To Cancel A Progressive Insurance Policy A Straightforward Guide

What Are Dallas Property Taxes?

Property taxes in Dallas are the fees levied on real estate by the local government. These taxes are based on the assessed value of your property and are used to fund various public services. Think of it as your contribution to making the city a better place to live.

Here's the deal: property taxes in Dallas can be a bit complicated. There are different tax districts, each with its own rates. And don't forget about the appraisal process, which determines the value of your property. But don't worry, we'll get into all that later.

How Are Dallas Property Taxes Calculated?

Calculating property taxes in Dallas involves a few key steps. First, the property is appraised to determine its market value. Then, the appraisal value is multiplied by the tax rate set by the local government. Simple, right? Well, not exactly.

- Fred Durst The Man Behind The Mic And Beyond

- Office Isabel The Ultimate Guide To Revolutionizing Your Workspace

Let's break it down:

- Property Appraisal: The Dallas Central Appraisal District (DCAD) assesses the value of your property.

- Tax Rate: Each tax district sets its own rate, which can vary depending on the services provided.

- Exemptions: Some homeowners may qualify for exemptions, which can lower their tax burden.

Understanding the Dallas Central Appraisal District (DCAD)

The Dallas Central Appraisal District plays a crucial role in the property tax process. It's responsible for determining the value of all properties in the city. This appraisal is used by the tax districts to calculate how much each property owner owes.

Now, here's the thing: the appraisal value isn't always the same as the market value. Sometimes, it can be higher or lower. That's why it's important to review your appraisal notice carefully. If you think the value is incorrect, you can file a protest.

How Does DCAD Determine Property Value?

DCAD uses several methods to determine the value of your property:

- Market Comparison: Comparing your property to similar properties that have recently sold.

- Cost Approach: Estimating how much it would cost to rebuild your property.

- Income Approach: For commercial properties, this method considers the income generated by the property.

Tax Rates in Dallas

Tax rates in Dallas vary depending on the tax district. Each district sets its own rate based on its budget needs. For example, the Dallas Independent School District (DISD) has its own tax rate, as do the city of Dallas and other local entities.

Here's a breakdown of the major tax districts in Dallas:

- Dallas Independent School District (DISD)

- City of Dallas

- Dallas County

- Special Districts (e.g., hospital districts, water districts)

How Do Tax Rates Affect You?

The tax rate directly impacts how much you pay in property taxes. A higher rate means a higher tax bill, and vice versa. That's why it's important to stay informed about the tax rates in your district. You can find this information on the DCAD website or by contacting your local tax office.

Exemptions and Deductions

Homeowners in Dallas may be eligible for various exemptions and deductions that can lower their property tax bill. These include:

- Homestead Exemption: Available to homeowners who use their property as their primary residence.

- Over 65/Disabled Exemption: Provides additional relief for seniors and disabled individuals.

- Energy Efficiency Exemption: For properties with energy-efficient features.

It's worth noting that you need to apply for these exemptions. They won't be automatically granted, so make sure to check with the DCAD or your local tax office for details.

How to Apply for Exemptions

Applying for exemptions is a straightforward process. You'll need to fill out the appropriate forms and provide any required documentation. The deadline for applications is typically around October, so don't wait until the last minute.

Protesting Your Property Tax Appraisal

If you believe your property's appraisal value is incorrect, you have the right to protest. This is an important step if you think you're being overcharged on your taxes. Here's how to do it:

- Review Your Appraisal Notice: Check for any errors or discrepancies.

- File a Protest: Submit a written protest to the DCAD by the deadline.

- Attend a Hearing: If necessary, you may need to attend a hearing to present your case.

Protesting your appraisal can be a bit intimidating, but it's a valuable right that can save you money. Just make sure to gather all the necessary evidence to support your claim.

Tips for a Successful Protest

Here are a few tips to increase your chances of success:

- Gather Comparable Sales Data: Show that similar properties in your area are appraised at a lower value.

- Document Property Issues: Highlight any issues with your property that may affect its value.

- Stay Polite and Professional: Remember, you're dealing with people, so keep things respectful.

Pay Your Dallas Property Taxes on Time

Paying your property taxes on time is crucial. Late payments can result in penalties and interest charges, which can add up quickly. That's why it's important to plan ahead and budget for your tax bill.

Here's how to pay your taxes:

- Online Payment: Many homeowners prefer the convenience of paying online.

- Mail-in Payment: You can also send a check or money order to the tax office.

- In-Person Payment: If you prefer, you can pay in person at the tax office.

What Happens If You Don't Pay?

If you fail to pay your property taxes, the consequences can be severe. The city can place a lien on your property, which can affect your ability to sell or refinance. In extreme cases, your property could even be foreclosed on. So, make sure to prioritize your tax payments.

Resources for Dallas Property Owners

There are several resources available to help Dallas property owners understand and manage their taxes:

- Dallas Central Appraisal District (DCAD): Provides information on appraisals and exemptions.

- Local Tax Offices: Offer assistance with tax payments and protests.

- Online Tools: Many websites offer calculators and other tools to help you estimate your tax bill.

Don't hesitate to reach out to these resources if you have questions or need help. Knowledge is power, and the more you know, the better prepared you'll be.

Stay Informed and Involved

Being an informed property owner is key to managing your taxes effectively. Attend local meetings, read the news, and stay up-to-date on any changes to tax laws or rates. Your involvement can make a difference in shaping the future of your community.

Conclusion

Dallas property taxes may seem overwhelming at first, but with a little knowledge and effort, you can navigate them successfully. Remember, these taxes fund essential services that benefit everyone in the city. So, while they may be a necessary expense, they also contribute to the quality of life in Dallas.

Here's a quick recap of what we've covered:

- Property taxes in Dallas are calculated based on appraisal value and tax rates.

- Exemptions and deductions can lower your tax bill.

- You have the right to protest your appraisal if you believe it's incorrect.

- Pay your taxes on time to avoid penalties.

Now, it's your turn. Leave a comment below and let me know if you have any questions or tips of your own. And don't forget to share this article with your fellow Dallas property owners. Together, we can make sense of the city of Dallas property taxes.

Table of Contents:

- Dallas Property Taxes: A Comprehensive Guide

- What Are Dallas Property Taxes?

- How Are Dallas Property Taxes Calculated?

- Understanding the Dallas Central Appraisal District (DCAD)

- Tax Rates in Dallas

- Exemptions and Deductions

- Protesting Your Property Tax Appraisal

- Pay Your Dallas Property Taxes on Time

- Resources for Dallas Property Owners

- Conclusion

- Who Is The Lead Singer Of Journey Discover The Voice Behind The Hits

- Fred Durst The Man Behind The Mic And Beyond

Dallas Property Tax Dallas Home Prices

Property Tax Rates in Dallas 2024 What to Know

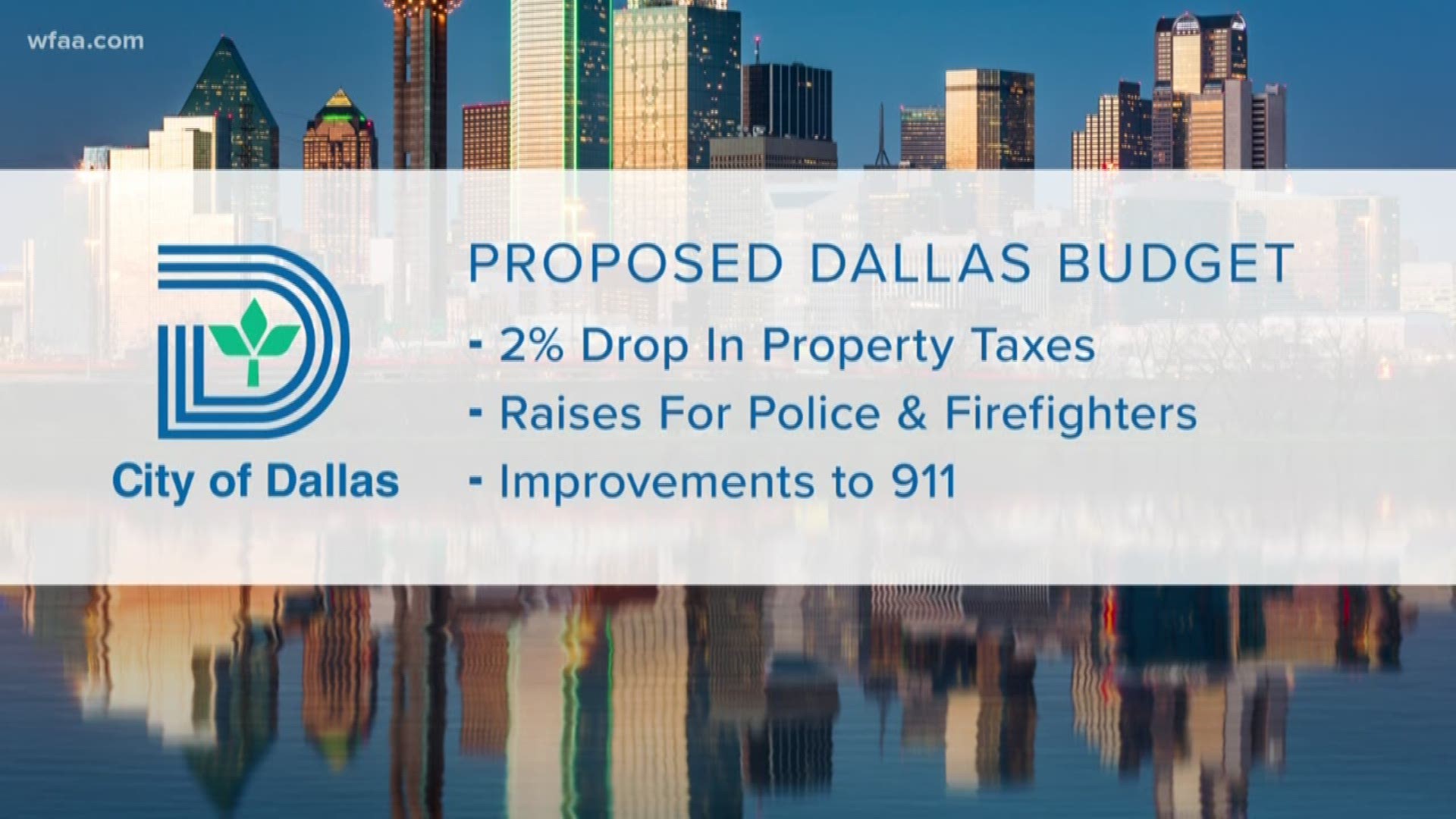

Dallas budget includes property tax cut