Conns Credit Payment: Your Ultimate Guide To Hassle-Free Financing

Alright folks, let's dive right into the world of Conns credit payment, because honestly, who doesn’t want to understand their financing options better? Whether you're planning a big purchase or just trying to keep your financial ducks in a row, knowing how Conns credit works can be a game-changer. Let me break it down for you in a way that’s easy to digest, so you won’t feel overwhelmed by all the financial jargon.

Conns credit payment is more than just a way to pay for stuff. It’s like having a trusted partner in your corner when you need to buy furniture, appliances, or electronics but don’t want to break the bank upfront. But before you jump into anything, it’s crucial to know what you’re getting into. That’s where this guide comes in—to give you the lowdown on how Conns credit works, its benefits, and some tips to make the most out of it.

Now, if you’re wondering why you should care about Conns credit payment, here’s the deal: it offers flexibility, competitive rates, and a straightforward process. But hey, we’ll get to all that in just a bit. First, let’s take a quick look at what this article will cover so you can navigate it easily. Trust me, you’re gonna want to stick around for this one.

- Unveiling The Vibrant Traditions In Venezuela For Christmas

- Oj Simpson Net Worth A Deep Dive Into The Life Career And Financial Empire

So, buckle up, grab your favorite snack, and let’s unravel the mystery behind Conns credit payment. By the end of this, you’ll be an expert on the subject—and trust me, that’s a good thing. Let’s go!

Table of Contents

- What is Conns Credit?

- How Does Conns Credit Payment Work?

- Eligibility Requirements for Conns Credit

- Benefits of Using Conns Credit Payment

- Common Questions About Conns Credit Payment

- How to Avoid Common Pitfalls with Conns Credit

- Conns Credit Payment Options

- Real-Life Customer Stories

- Conns Credit vs Other Financing Options

- Final Thoughts on Conns Credit Payment

What is Conns Credit?

Alright, let’s start with the basics. What exactly is Conns credit? In simple terms, it’s a financing option provided by Conns, a retail company that specializes in offering furniture, appliances, and electronics. When you shop at Conns, you can choose to pay for your purchases using their credit program instead of paying the full amount upfront. It’s kind of like having a store-specific credit card, but with some unique perks.

Conns credit isn’t just about buying stuff; it’s about making those purchases more manageable. You can spread out the cost over time, which can be a lifesaver if you’re working within a budget. Plus, they offer deferred interest plans, which means you might not have to pay interest if you pay off your balance within a certain period. Sounds pretty sweet, right?

- Grocery Store Carolina Beach Nc Your Ultimate Guide To Fresh Finds

- Melissa Roxburgh The Rising Star Whos Capturing Hearts

Here’s the thing though: it’s not just about the convenience. Conns credit payment is designed to help people who might not qualify for traditional financing options. They focus on providing credit solutions for everyone, regardless of their credit history. That’s why it’s become such a popular choice for so many consumers.

Why Choose Conns Credit?

There are plenty of reasons why someone might opt for Conns credit payment. For starters, it’s super easy to apply for. You can do it right in the store or online, and you’ll usually get an answer pretty quickly. Plus, their customer service team is known for being helpful and responsive, which is always a plus.

Another big draw is the variety of products you can finance through Conns. From living room sets to washing machines, they’ve got you covered. And let’s not forget about the deferred interest plans, which can save you a ton of money if you manage to pay off your balance on time.

Of course, like any financing option, there are some things to keep in mind. We’ll get into those later, but for now, just know that Conns credit payment can be a great tool if used wisely.

How Does Conns Credit Payment Work?

Alright, so you’re interested in Conns credit payment, but how does it actually work? Let’s break it down step by step so you’ve got a clear picture of what to expect.

First things first, you’ll need to apply for Conns credit. You can do this either in-store or online. The application process is pretty straightforward—you’ll just need to provide some basic information like your name, address, and social security number. Once you submit your application, you’ll usually get a decision within minutes.

If you’re approved, congratulations! You’re now ready to start using your Conns credit. When you make a purchase, you’ll have the option to pay with your Conns credit account. The total cost of your purchase will be added to your credit balance, and you’ll start making monthly payments based on the terms of your agreement.

One of the coolest things about Conns credit payment is the deferred interest plans. If you qualify, you might be able to pay off your balance without accruing any interest during a specified promotional period. However, it’s important to note that if you don’t pay off your balance in full by the end of that period, you’ll be charged interest retroactively from the date of purchase. So, it’s crucial to stay on top of your payments.

Key Features of Conns Credit Payment

- Deferred Interest Plans: Pay no interest if you pay off your balance within the promotional period.

- Flexible Payment Options: Choose from different payment plans to suit your budget.

- Easy Application Process: Apply online or in-store and get a decision quickly.

- Wide Range of Products: Finance furniture, appliances, electronics, and more.

So, as you can see, Conns credit payment is more than just a way to finance your purchases—it’s a tool that can help you manage your finances more effectively. But before you jump in, there are a few things you need to know about eligibility.

Eligibility Requirements for Conns Credit

Now, let’s talk about who can qualify for Conns credit payment. While Conns is known for being more flexible than traditional lenders, there are still some requirements you’ll need to meet.

First up, you’ll need to be at least 18 years old to apply. You’ll also need to provide proof of income, as this will help determine your credit limit. Conns considers a variety of factors when evaluating your application, including your credit score, employment history, and debt-to-income ratio.

Here’s the good news: Conns doesn’t require a perfect credit score to get approved. In fact, they’re known for offering credit solutions to people with less-than-perfect credit. However, your credit score will still play a role in determining your interest rate and credit limit.

Tips for Improving Your Chances of Approval

- Check Your Credit Report: Make sure there are no errors that could hurt your chances of approval.

- Provide Accurate Information: Be honest about your income and expenses when filling out your application.

- Pay Down Existing Debt: Lowering your debt-to-income ratio can improve your chances of getting approved.

Remember, even if you don’t get approved right away, you can always work on improving your credit and reapply later. Conns credit payment is all about giving people a second chance, so don’t get discouraged if you don’t qualify at first.

Benefits of Using Conns Credit Payment

Alright, let’s talk about the good stuff—the benefits of using Conns credit payment. There are plenty of reasons why this financing option stands out from the crowd.

For starters, Conns credit offers competitive interest rates, especially if you have good credit. And as we mentioned earlier, their deferred interest plans can save you a ton of money if you pay off your balance within the promotional period. Plus, they offer flexible payment options, so you can choose a plan that fits your budget.

Another big benefit is the convenience factor. You can apply for Conns credit right in the store or online, and you’ll usually get a decision quickly. This makes it super easy to finance your purchases without having to jump through a bunch of hoops.

Other Perks of Conns Credit

- No Annual Fees: You won’t have to worry about paying extra fees just to have a Conns credit account.

- Customer Support: Conns has a dedicated customer service team that’s available to help you with any questions or issues.

- Building Credit: Using Conns credit responsibly can help you build or improve your credit score over time.

So, as you can see, there are plenty of reasons why Conns credit payment is worth considering. But like anything, there are some things to watch out for. Let’s talk about those next.

Common Questions About Conns Credit Payment

Let’s address some of the most common questions people have about Conns credit payment. If you’ve got any doubts or concerns, chances are you’re not alone.

Q: Can I use Conns credit anywhere?

A: Conns credit is primarily designed for use at Conns stores or on their website. However, they do offer some partner programs that might allow you to use your credit elsewhere.

Q: What happens if I miss a payment?

A: If you miss a payment, you’ll likely be charged a late fee, and it could negatively impact your credit score. It’s important to stay on top of your payments to avoid any issues.

Q: Can I pay off my balance early?

A: Absolutely! Paying off your balance early is a great way to avoid interest charges and save money in the long run.

Other FAQs

- How long does the application process take? Usually just a few minutes.

- What happens if I don’t pay off my balance during the deferred interest period? You’ll be charged interest retroactively from the date of purchase.

- Can I increase my credit limit? Yes, you can request a credit limit increase after using your account responsibly for a period of time.

These are just a few of the most common questions people have about Conns credit payment. If you’ve got more, don’t hesitate to reach out to Conns customer service for clarification.

How to Avoid Common Pitfalls with Conns Credit

Alright, let’s talk about some common pitfalls to avoid when using Conns credit payment. While this financing option can be incredibly helpful, it’s important to use it wisely to avoid any potential issues.

One of the biggest pitfalls is not paying off your balance during the deferred interest period. If you don’t pay off your balance in full by the end of the promotional period, you’ll be charged interest retroactively from the date of purchase. This can add up quickly, so it’s crucial to stay on top of your payments.

Another thing to watch out for is overspending. It’s easy to get carried away when you know you can finance your purchases, but it’s important to stick to your budget. Only finance what you can realistically afford to pay back, and don’t let yourself get in over your head.

Tips for Responsible Use

- Set a Budget: Decide how much you can afford to spend before you start shopping.

- Track Your Payments: Keep an eye on your account to make sure you’re staying on track with your payments.

- Pay More Than the Minimum: If you can afford it, paying more than the minimum each month can help you pay off your balance faster and save on interest.

By following these tips, you can avoid some of the common pitfalls associated with Conns credit payment and make the most out of this financing option.

Conns Credit Payment Options

Alright, let’s talk about the different payment options

- March 30 Horoscope Unlock Your Zodiac Energy And Predictions For Today

- Discover Your Inner Glow Birth Sign For August 28 And What It Means For You

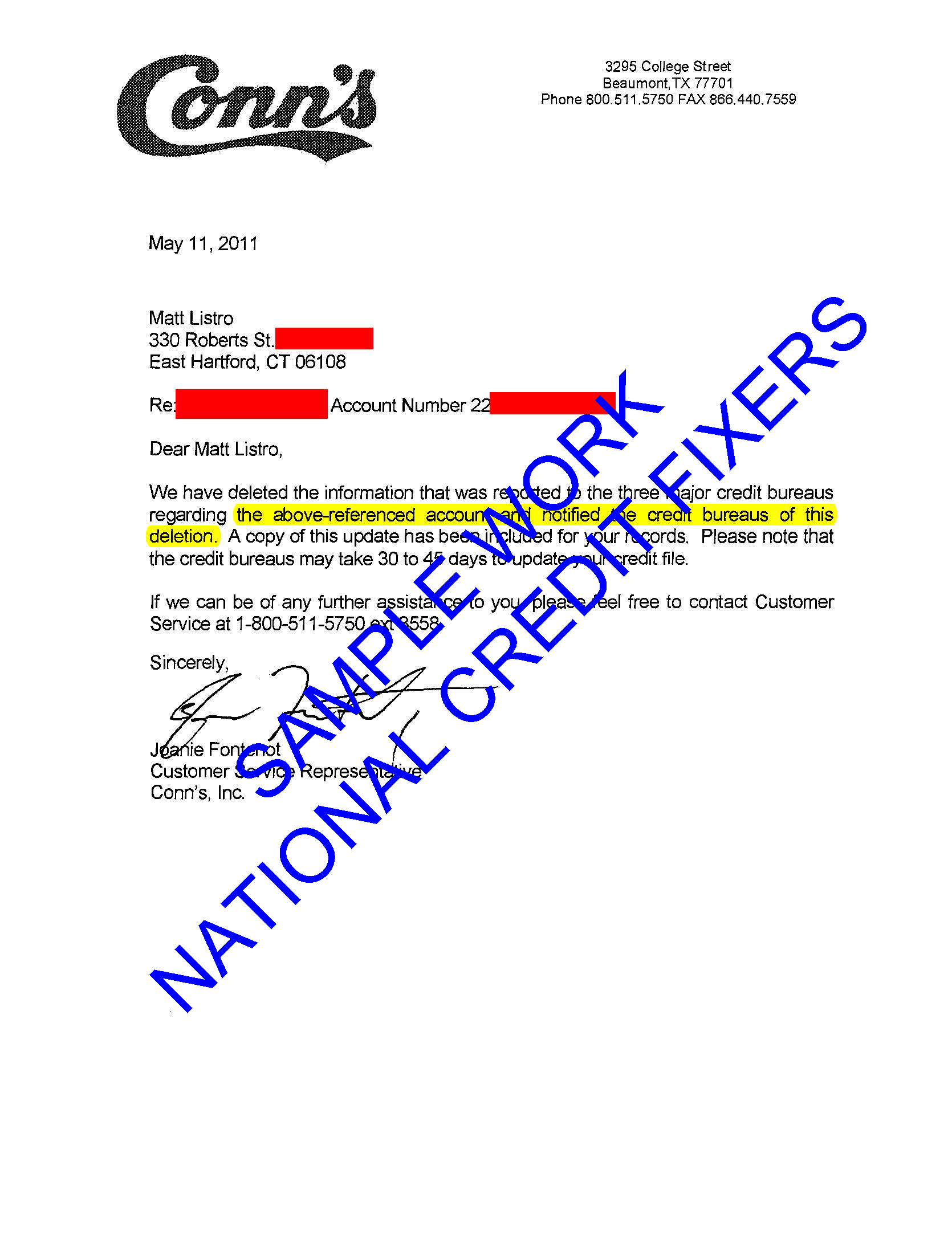

Success Stories Samples Of Our Work Conns Deletion

Premium Photo Woman using credit card register payment online

Easy Payment Solutions for Conns Furniture Shopping