Does Chase Bank Have Pesos? Unlocking The Truth About Chase Bank's Currency Services

Have you ever wondered if Chase Bank offers peso transactions? If you're planning a trip to Mexico or another peso-using country, this question might be on your mind. Chase Bank is one of the largest financial institutions in the US, but does it really cater to international currency needs like pesos? Let's dive into the details and uncover what Chase Bank has to offer when it comes to foreign currencies.

Let's be real—handling international transactions can get tricky. Whether you're traveling abroad or sending money to loved ones overseas, having access to pesos through a trusted bank is crucial. But does Chase Bank have you covered? That's the million-dollar—or should we say peso—question we're here to answer today.

In this article, we'll break down everything you need to know about Chase Bank's currency services, with a special focus on pesos. From wire transfers to currency exchange options, we'll guide you through the process step by step. So buckle up and let's get started!

- Vanessa Marcil Boyfriend The Ultimate Guide To Her Love Life

- Ac Slater From Saved By The Bell The Ultimate Dive Into The Iconic Character

Understanding Chase Bank's Role in International Transactions

Chase Bank, part of JPMorgan Chase, is a global financial powerhouse. But when it comes to international currencies like pesos, how does it fit into the picture? Chase offers a range of services designed to make global transactions easier for its customers. While it doesn't physically stock pesos in its branches, it provides multiple ways to access this currency through its platforms.

Here's the deal: Chase Bank focuses on digital solutions for international transactions. This means you won't find stacks of pesos sitting in your local branch, but you can still access them through wire transfers, currency exchanges, or even through its international banking partners. Let's explore these options in more detail.

Does Chase Bank Offer Peso Transactions?

Short answer: Yes, but indirectly. Chase Bank doesn't deal directly with physical pesos, but it allows customers to send money to accounts in peso-denominated currencies. This is typically done through wire transfers or online payment systems. Here's how it works:

- Nbc News Logo The Iconic Emblem That Speaks Volumes

- Anthony Junior Soprano The Untold Story Of A Complex Character

- Wire Transfers: Chase enables you to send money to accounts in foreign currencies, including pesos. You'll need the recipient's bank details and ensure the transaction is set up in the correct currency.

- Online Banking: Chase's online platform makes it easy to initiate international transfers without stepping into a branch.

- Exchange Rates: Keep in mind that Chase may apply a conversion fee or use a slightly adjusted exchange rate, so always double-check the details before finalizing a transaction.

So while Chase doesn't hand out pesos over the counter, it provides reliable ways to transfer funds in this currency. Let's move on to the nitty-gritty of how this works.

How Chase Bank Handles Currency Exchange

Chase Bank's approach to currency exchange is all about convenience and accessibility. Whether you're traveling abroad or managing international finances, Chase has tools to help you navigate the world of foreign currencies. Here's a closer look at how Chase handles currency exchange:

Chase's Currency Exchange Options

Chase offers several ways to exchange currency, though physical peso availability is limited. Instead, the focus is on digital solutions:

- Online Platforms: Chase's online banking system allows you to initiate currency exchanges and international transfers effortlessly.

- Mobile App: The Chase Mobile app is a game-changer for managing international transactions on the go.

- Partnerships: Chase collaborates with global banking partners to facilitate seamless currency exchanges in various countries.

While Chase doesn't physically stock pesos, its digital infrastructure ensures you can still access this currency when needed. It's all about leveraging technology to meet your international financial needs.

Steps to Send Money in Pesos Using Chase Bank

Ready to send money in pesos through Chase Bank? Here's a step-by-step guide to help you navigate the process:

Step 1: Gather Necessary Information

Before initiating a transfer, make sure you have the following details:

- Recipient's full name and address

- Recipient's bank account number

- Swift code or routing number of the recipient's bank

- Amount to be sent in pesos

Step 2: Log in to Chase Online Banking

Head to Chase's website or open the Chase Mobile app. Log in to your account and navigate to the "Transfer Money" or "Send Money Internationally" section.

Step 3: Initiate the Transfer

Enter the recipient's details and specify the amount in pesos. Chase will calculate the exchange rate and any associated fees. Review the transaction details carefully before confirming.

Pro tip: Always check the exchange rate beforehand to ensure you're getting a fair deal. Chase's rates are generally competitive, but it's good to compare with other providers if you're handling large sums.

Chase Bank's Fees for International Transfers

Let's talk fees. While Chase Bank offers convenient international transfer services, there are costs involved. Here's a breakdown of what you can expect:

Exchange Rate Fees

Chase typically applies a markup on the exchange rate when converting USD to pesos. This markup can vary depending on the amount and destination of the transfer. Always review the exchange rate details before confirming the transaction.

Wire Transfer Fees

Chase charges fees for outgoing wire transfers. As of 2023, the fee for domestic wire transfers is around $15, while international wire transfers can cost up to $50. Additionally, the recipient's bank may charge incoming fees, so it's wise to confirm this with the recipient beforehand.

While these fees might seem steep, Chase's reliability and security make it a worthwhile choice for many customers. Plus, the convenience of managing everything online often outweighs the cost for frequent international users.

Alternatives to Chase for Peso Transactions

If Chase Bank's fees or processes don't align with your needs, there are other options available for peso transactions. Here are a few alternatives to consider:

1. Online Money Transfer Services

Platforms like Wise, Revolut, and PayPal offer competitive exchange rates and lower fees for international transfers. These services often provide better transparency and faster processing times compared to traditional banks.

2. Local Currency Exchange Providers

For physical peso transactions, local currency exchange providers might be a better fit. These services often have better rates for cash exchanges and can provide pesos on demand.

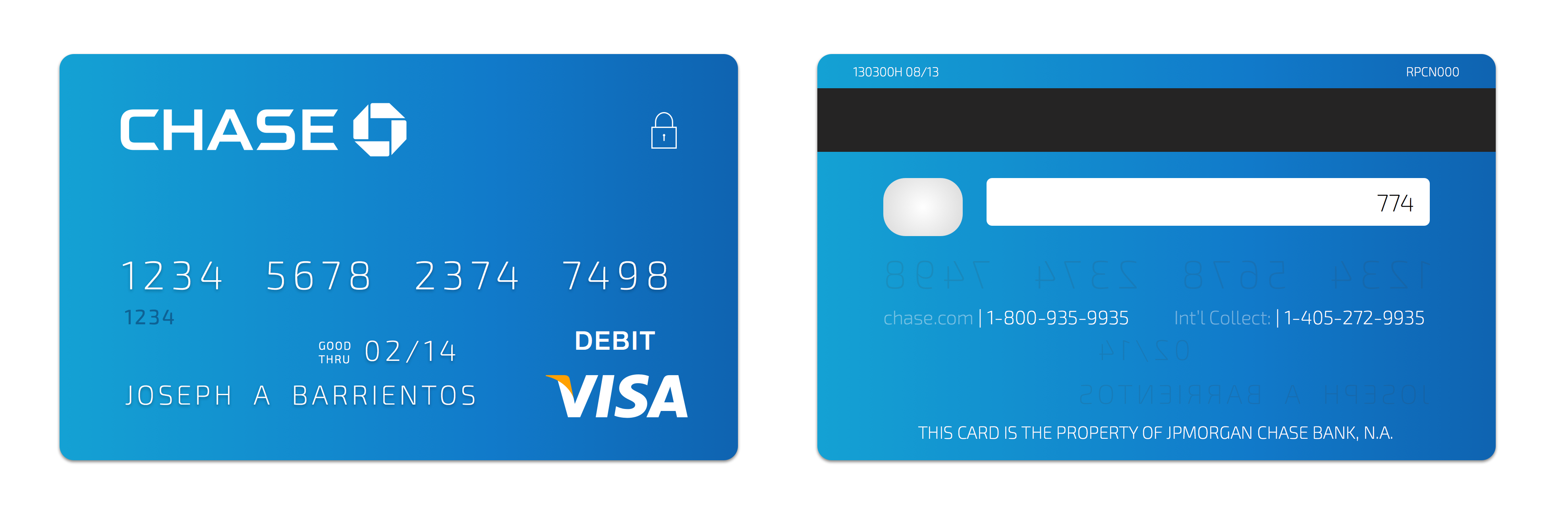

3. Credit Cards and Debit Cards

If you're traveling to a peso-using country, consider using a Chase credit or debit card. Many cards offer favorable exchange rates and minimal foreign transaction fees, making them a convenient option for everyday spending.

Ultimately, the best choice depends on your specific needs and preferences. Chase Bank remains a solid option for many, but exploring alternatives can sometimes yield better results.

Chase Bank's Global Banking Partnerships

One of Chase Bank's strengths lies in its extensive network of global banking partnerships. These collaborations enable seamless transactions across borders, including peso-denominated transfers. Here's how these partnerships work:

How Partnerships Enhance Chase's Services

By partnering with local banks in peso-using countries, Chase ensures faster and more reliable transfers. These partnerships often result in better exchange rates and reduced processing times. For example, Chase works closely with major Mexican banks to facilitate peso transactions efficiently.

Pro tip: If you frequently send money to the same country, consider setting up a recurring transfer. Chase's partnerships make it easy to automate these transactions, saving you time and effort in the long run.

Security and Reliability of Chase Bank's International Services

When it comes to international transactions, security and reliability are paramount. Chase Bank takes these aspects seriously, employing advanced encryption and fraud detection technologies to protect your funds. Here's what you can expect:

Security Features

- Two-Factor Authentication: Chase requires additional verification steps for sensitive transactions, ensuring only authorized users can access your account.

- Fraud Monitoring: Chase actively monitors your account for suspicious activity and alerts you if anything unusual occurs.

- Insurance Coverage: Chase provides insurance coverage for eligible transactions, giving you peace of mind when sending money internationally.

With these robust security measures in place, Chase Bank remains a trusted choice for international financial transactions.

Conclusion: Does Chase Bank Have Pesos?

In summary, Chase Bank doesn't physically stock pesos, but it offers reliable ways to access this currency through its international services. Whether you're sending money to a loved one in Mexico or managing global finances, Chase provides the tools and support you need to navigate the world of foreign currencies.

So, does Chase Bank have pesos? The answer is yes—indirectly. With its digital platforms, global partnerships, and secure transaction systems, Chase makes it easy to handle peso-denominated transactions from the comfort of your home.

Ready to take action? If you're planning an international transaction, now's the time to explore Chase Bank's services. Don't forget to compare fees and exchange rates to ensure you're getting the best deal. And as always, feel free to share your thoughts or ask questions in the comments below. Happy banking!

Table of Contents

- Does Chase Bank Have Pesos? Unlocking the Truth About Chase Bank's Currency Services

- Understanding Chase Bank's Role in International Transactions

- Does Chase Bank Offer Peso Transactions?

- How Chase Bank Handles Currency Exchange

- Steps to Send Money in Pesos Using Chase Bank

- Chase Bank's Fees for International Transfers

- Alternatives to Chase for Peso Transactions

- Chase Bank's Global Banking Partnerships

- Security and Reliability of Chase Bank's International Services

- Conclusion: Does Chase Bank Have Pesos?

- Bronwyn Rings Of Power The Unsung Heroine You Need To Know About

- How Old Is Governor Tim Walz A Deep Dive Into His Age Legacy And Leadership

Leads Rally in Big Bank Stocks as Regional Lenders Lag (JPM

A Comprehensive Guide To Chase Bank Notary And Crypto Services

2025 Chase Debit Card Sana Luna