Travis County Tax Appraisal: A Deep Dive Into What You Need To Know

**Listen up, folks! If you're living in Travis County or planning to buy property there, understanding the ins and outs of Travis County tax appraisal is crucial. This isn’t just some boring paperwork—it’s your money we’re talking about. Whether you’re a homeowner, investor, or just someone curious about how property taxes work, this article is here to break it down for you in simple terms. So grab a coffee, sit back, and let’s unravel the mystery behind Travis County tax appraisal.**

You might be thinking, "What’s the big deal? It's just taxes." But trust me, it’s more than that. The tax appraisal process in Travis County affects everything from your mortgage payments to your overall financial health. If you’re not paying attention, you could end up overpaying or missing out on opportunities to save. And nobody wants that, right?

In this article, we’ll cover everything you need to know about Travis County tax appraisal. From how the process works to tips for appealing your appraisal, we’ve got you covered. So, let’s dive in and make sure you’re armed with the knowledge to protect your wallet and your peace of mind.

- What Is Jaspers Power Unleashing The Hidden Potential

- Who Won Teen Choice Awards In 2008 A Blast From The Past

Table of Contents

- What is Travis County Tax Appraisal?

- How Does the Appraisal Process Work?

- Key Factors Affecting Property Value

- Understanding the Tax Rate

- Appealing Your Tax Appraisal

- Common Mistakes to Avoid

- Resources for Homeowners

- How to Save on Property Taxes

- Frequently Asked Questions

- Final Thoughts

What is Travis County Tax Appraisal?

Alright, let’s start with the basics. The Travis County Tax Appraisal District (TCAD) is responsible for determining the value of all properties within Travis County. This value is then used to calculate your property taxes. Think of it like this: the appraisal district is like a big team of evaluators who walk around, look at your house, and decide how much it’s worth. And that number? Yeah, that’s what determines how much you pay in taxes.

But here’s the thing—property appraisal isn’t always perfect. Sometimes, the value they assign might be too high, which means you could end up paying more than you should. That’s why it’s super important to understand how the system works and know your rights as a homeowner.

So, in short, Travis County tax appraisal is the process of determining the taxable value of your property. It’s a big deal because it directly affects how much you owe in property taxes. And hey, who doesn’t want to keep more of their hard-earned cash?

- Discover The Allure Of Norway Culture A Deep Dive Into Scandinavian Traditions

- Who Was Gus Fring In Chile Unveiling The Elusive Drug Lord

How Does the Appraisal Process Work?

Let’s break down the appraisal process into bite-sized chunks so it’s easier to digest. The TCAD uses a few different methods to determine the value of your property. They look at things like:

- Comparable sales in your area

- The size and condition of your home

- Any recent renovations or improvements

- Market trends and economic factors

Once they’ve gathered all this info, they come up with an estimated market value for your property. This value is then sent to you in the form of a notice. Now, here’s where it gets interesting—you don’t have to just accept this number. If you think it’s too high, you can appeal the decision. More on that later.

It’s also worth noting that the appraisal process happens annually. So, every year, you’ll receive a new appraisal notice. This means you need to stay on top of things and make sure everything is accurate. Trust me, it’s worth the effort.

Key Steps in the Appraisal Process

Here’s a quick rundown of the key steps involved in the appraisal process:

- Property inspection

- Data collection and analysis

- Value determination

- Notice of appraised value

- Opportunity for appeal

Each step plays a crucial role in ensuring that your property is valued fairly. But remember, the system isn’t perfect. That’s why it’s important to stay informed and proactive.

Key Factors Affecting Property Value

So, what exactly affects the value of your property? There are several factors that come into play, and understanding them can help you better understand your appraisal notice. Here are some of the main factors:

- Location: As they say, location, location, location. Properties in desirable areas tend to have higher values.

- Size: The size of your home, including the number of bedrooms and bathrooms, can significantly impact its value.

- Condition: The overall condition of your property, including any repairs or upgrades, affects its appraised value.

- Market Trends: Economic conditions and market trends can also influence property values.

For example, if your neighborhood is experiencing a surge in new developments or if there’s a high demand for homes in your area, your property value might increase. On the flip side, if the local economy is struggling, your property value could decrease.

How Market Trends Impact Appraisal

Market trends are a big deal when it comes to property appraisal. They can fluctuate based on a variety of factors, including interest rates, employment rates, and population growth. For instance, if interest rates are low, more people might be buying homes, which can drive up property values. Conversely, if the job market is struggling, fewer people might be able to afford homes, leading to a decrease in property values.

Staying informed about these trends can help you better understand your appraisal and make informed decisions about your property.

Understanding the Tax Rate

Alright, let’s talk about the tax rate. The tax rate is what determines how much you actually pay in property taxes. It’s calculated by multiplying the appraised value of your property by the tax rate set by local governments. For example, if your home is appraised at $300,000 and the tax rate is 2%, you’d owe $6,000 in property taxes.

But here’s the kicker—the tax rate can vary depending on where you live within Travis County. Different cities and school districts have different tax rates, so it’s important to know which ones apply to you. You can usually find this info on the TCAD website or by contacting your local tax office.

Also, keep in mind that tax rates can change from year to year. So, even if your property value stays the same, your tax bill might still fluctuate based on changes in the tax rate.

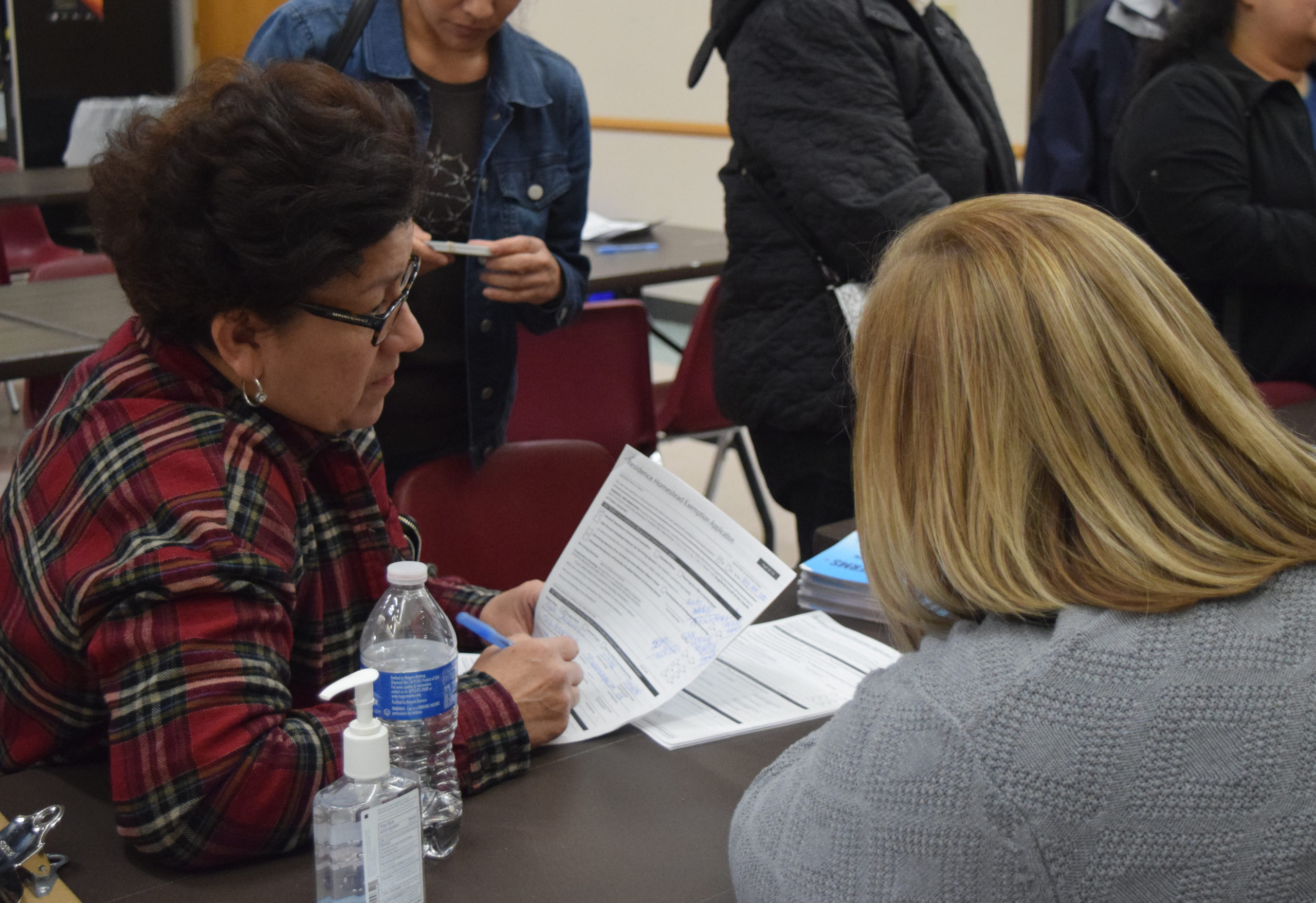

Appealing Your Tax Appraisal

If you think your appraisal is too high, you have the right to appeal. Here’s how the process works:

- File a protest with the Travis Central Appraisal District

- Gather evidence to support your case, such as comparable sales data or a professional appraisal

- Attend a hearing with the Appraisal Review Board (ARB)

- Receive a decision from the ARB

Now, appealing your appraisal might sound intimidating, but it’s actually a pretty straightforward process. The key is to have solid evidence to back up your claim. If you can show that similar properties in your area are being valued lower, or if you’ve made recent improvements that weren’t accounted for, you have a good chance of getting your appraisal adjusted.

Tips for a Successful Appeal

Here are a few tips to help you succeed in your appeal:

- Gather as much evidence as possible

- Be polite and professional in your communication

- Know the deadlines for filing a protest

- Consider hiring a professional if your case is complex

Remember, appealing your appraisal is your right as a homeowner. Don’t be afraid to stand up for yourself and make sure you’re not overpaying on your property taxes.

Common Mistakes to Avoid

Now, let’s talk about some common mistakes people make when it comes to Travis County tax appraisal. Avoiding these pitfalls can save you a lot of headaches down the road.

- Not reviewing your appraisal notice: This is a big one. A lot of people just toss their appraisal notice aside without giving it a second glance. Don’t do that! Take the time to review it carefully and make sure everything is accurate.

- Missing the deadline for appeal: There’s usually a limited window for filing a protest, so make sure you don’t miss it.

- Not gathering evidence: If you plan to appeal, you need to have solid evidence to support your case. Don’t go into it blindly.

By avoiding these common mistakes, you can ensure that you’re getting a fair appraisal and not overpaying on your property taxes.

Resources for Homeowners

There are plenty of resources available to help you navigate the world of Travis County tax appraisal. Here are a few you might find useful:

- Travis Central Appraisal District Website: This is your go-to source for all things related to property appraisal in Travis County.

- Local Tax Offices: If you have specific questions about your tax bill or appraisal, don’t hesitate to reach out to your local tax office.

- Professional Appraisers: If you’re considering appealing your appraisal, a professional appraiser can provide valuable insight and support.

These resources can help you stay informed and make smart decisions about your property taxes.

How to Save on Property Taxes

Who doesn’t want to save money, right? Here are a few strategies to help you reduce your property tax bill:

- Appeal your appraisal: If you think your appraisal is too high, don’t hesitate to file a protest.

- Take advantage of exemptions: Depending on your situation, you might qualify for certain exemptions, such as homestead exemptions or senior citizen exemptions.

- Stay informed about market trends: Keeping an eye on market trends can help you better understand your appraisal and make informed decisions.

By using these strategies, you can save money on your property taxes and keep more of your hard-earned cash in your pocket.

Frequently Asked Questions

What is the Travis County Tax Appraisal District?

The Travis County Tax Appraisal District (TCAD) is responsible for determining the value of all properties within Travis County. This value is then used to calculate property taxes.

How often does the appraisal process happen?

The appraisal process happens annually. You’ll receive a new appraisal notice every year.

Can I appeal my appraisal?

Yes, you can appeal your appraisal if you think it’s too high. The process involves filing a protest with the TCAD and providing evidence to support your case.

Final Thoughts

So, there you have it—a comprehensive guide to Travis County tax appraisal. Whether you’re a seasoned homeowner or a first-time buyer, understanding this process is crucial for protecting your financial well-being. By staying informed and proactive, you can ensure that you’re not overpaying on your property taxes.

Remember, the key is to review your appraisal notice carefully, gather evidence if needed, and don’t hesitate to appeal if you think your appraisal is too high. And hey, if you ever need more info, there are plenty of resources available to help you along the way.

So, what are you waiting for? Take control of your property taxes and make sure you’re getting a fair deal. Your wallet

- La County Fair Tickets Cost Your Ultimate Guide To Affordable Fun

- Snap Balance Tn The Ultimate Guide To Unlocking Your Financial Potential

Proposed Property Tax Bills Now Available Online for Travis County

Travis County Property Tax Valuations Travis County

Careers Travis Central Appraisal District