State Farm Comprehensive Coverage: Your Ultimate Guide To Protecting Your Vehicle

When it comes to protecting your car, State Farm comprehensive coverage is like having a superhero in your corner. It’s not just another insurance product—it’s peace of mind wrapped in a policy. Whether you’re dealing with theft, vandalism, or natural disasters, this coverage has got your back. Let’s dive into why State Farm comprehensive coverage might be the perfect fit for you and how it works its magic.

Imagine driving down the road, knowing that no matter what life throws at you, your car is protected. That’s exactly what State Farm comprehensive coverage offers. It’s more than just an extra layer of security; it’s a safeguard against the unexpected. From hailstorms to hit-and-runs, this coverage ensures you’re never left stranded.

But hold up—before we get too far ahead of ourselves, let’s break down the basics. Understanding comprehensive coverage and how State Farm handles it can make all the difference in your decision-making process. So grab a cup of coffee, sit back, and let’s explore everything you need to know about this essential part of your insurance plan.

- The Night At The Museum Cast A Deep Dive Into The Magic Of The Movie

- Discover The Ultimate Guide To Foodtown Davie Florida

What Exactly is State Farm Comprehensive Coverage?

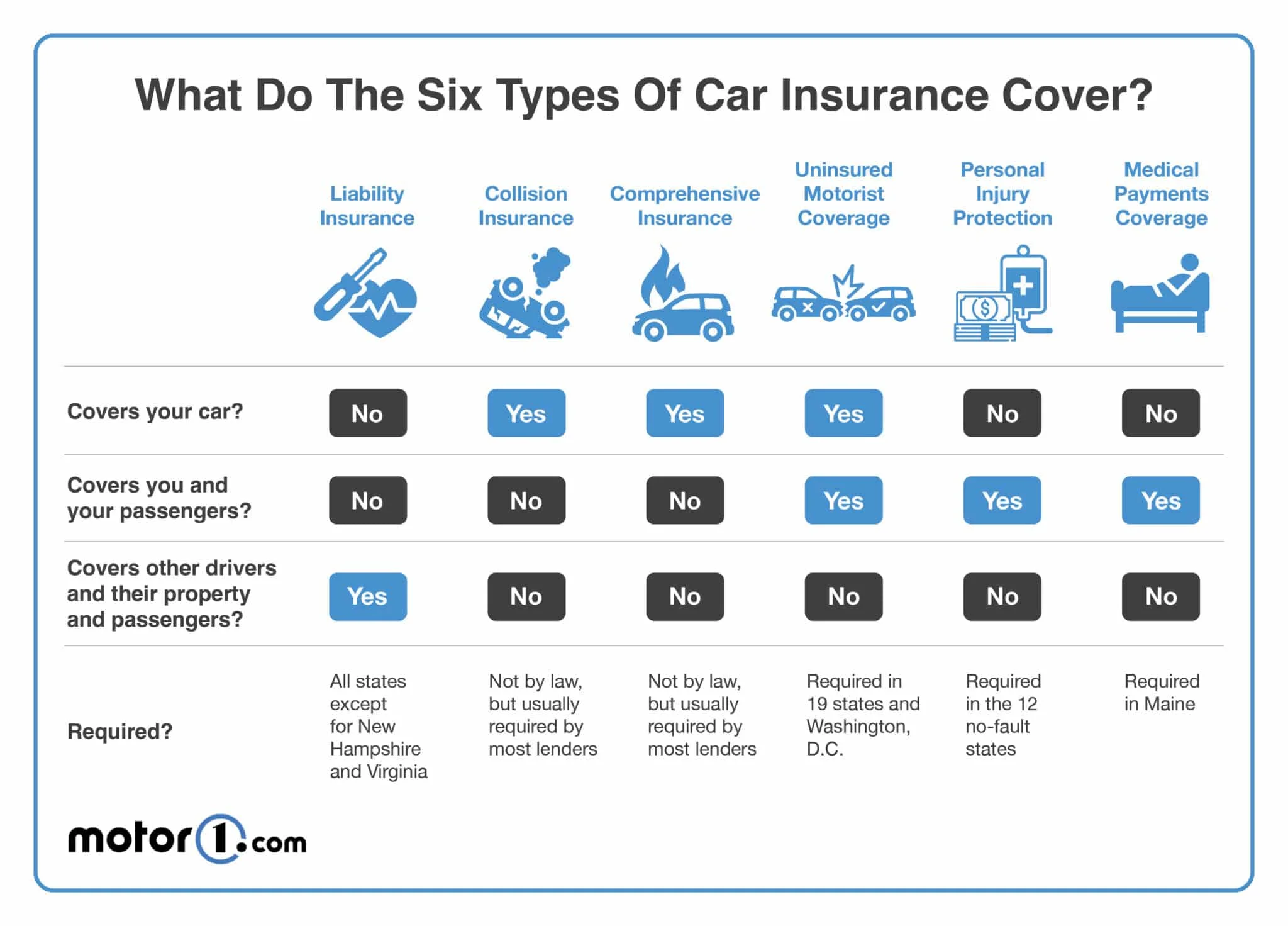

Alright, here’s the deal: State Farm comprehensive coverage is designed to cover damages to your vehicle caused by non-collision incidents. Think about it like this—if something happens to your car that isn’t directly related to an accident with another vehicle, this coverage steps in to help. It’s kind of like a safety net for all those "what if" scenarios.

Now, here’s where it gets interesting. Comprehensive coverage doesn’t just stop at one type of incident. It covers a wide range of situations, including theft, fire, falling objects, animal collisions, and even natural disasters. So whether a tree falls on your car during a storm or a deer decides to make a surprise appearance on the highway, you’re covered.

And let’s not forget about vandalism. If someone decides to take their frustrations out on your car, State Farm comprehensive coverage can help repair the damage. It’s like having a personal bodyguard for your vehicle, but instead of muscles, it’s got paperwork and protection.

- Saint Bernard Lifespan Understanding The Journey Of This Gentle Giant

- Mcdonalds Mankato Your Ultimate Guide To The Best Burgers In Town

Why Choose State Farm for Comprehensive Coverage?

Here’s the thing—when it comes to insurance, you want a company that’s reliable, trustworthy, and has your best interests at heart. That’s where State Farm shines. As one of the largest insurance providers in the U.S., they’ve got the experience and resources to handle whatever comes your way.

But it’s not just about size—it’s about service. State Farm agents are known for their personalized approach, meaning you’ll get tailored advice and solutions based on your specific needs. Plus, with their vast network of agents and claims adjusters, you’ll always have someone nearby to assist you when you need it most.

And let’s talk numbers. According to a recent study by J.D. Power, State Farm ranks high in customer satisfaction for both claims handling and policy service. That’s a pretty big deal when you’re dealing with something as important as your vehicle.

Understanding the Benefits of State Farm Comprehensive Coverage

Let’s be real—nobody buys insurance hoping to use it, but when you need it, you’re glad it’s there. State Farm comprehensive coverage offers several key benefits that make it a worthwhile investment. First and foremost, it provides financial protection against unforeseen events that could otherwise leave a dent in your wallet.

For example, if your car gets stolen, comprehensive coverage can help cover the cost of replacing it. Or, if a hailstorm damages your windshield, this coverage can help with repairs. It’s like having a financial buffer for those unexpected moments in life.

Plus, comprehensive coverage often comes with additional perks, like rental car reimbursement and towing services. So if your car is out of commission while repairs are being made, you’ve got options to keep you on the road.

What’s Covered Under State Farm Comprehensive Coverage?

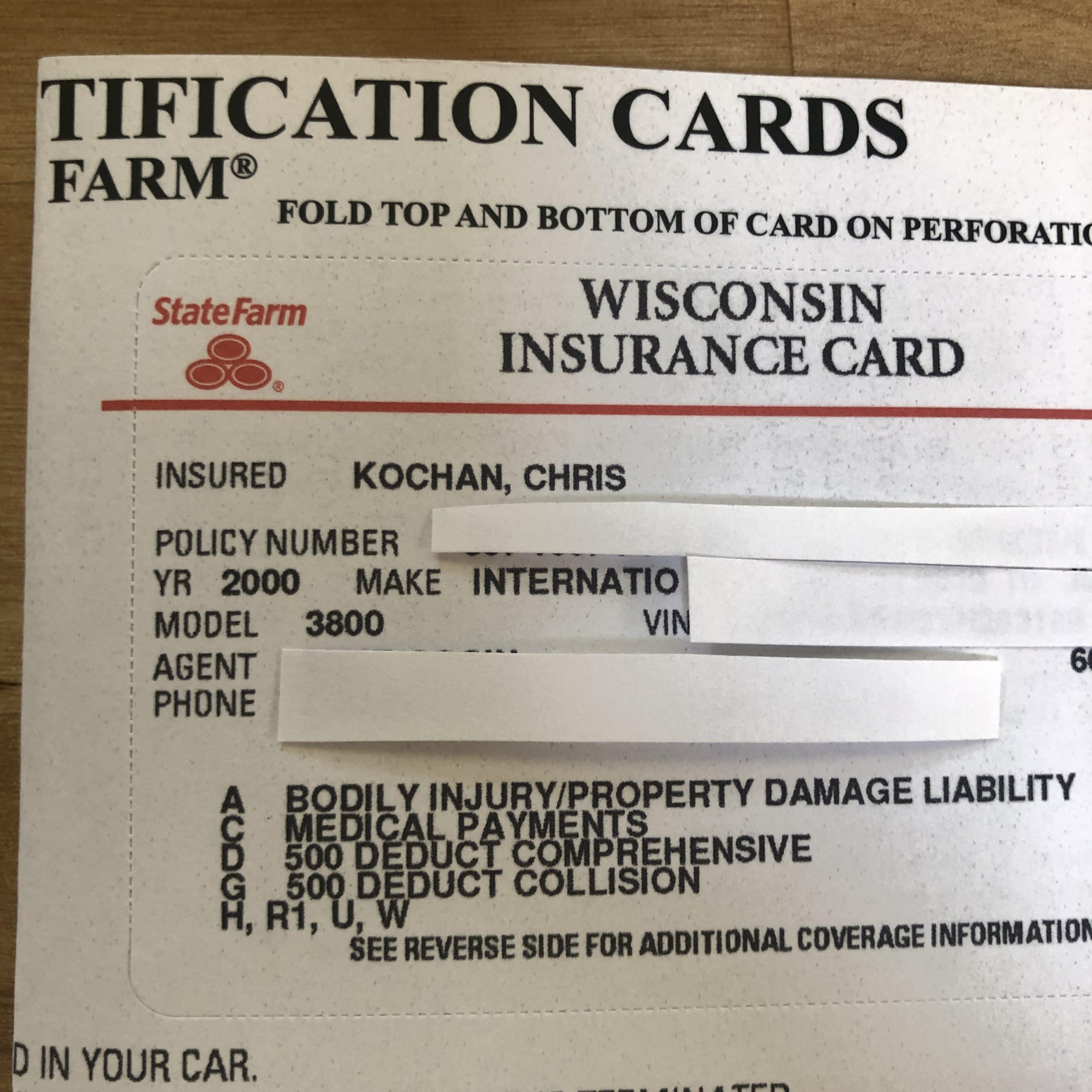

This is where things get specific. State Farm comprehensive coverage typically covers the following:

- Theft

- Vandalism

- Falling objects

- Natural disasters (hail, floods, earthquakes, etc.)

- Animal collisions

- Fire

- Explosions

It’s important to note that each policy may vary slightly depending on your location and specific coverage options. That’s why it’s always a good idea to review your policy details with your State Farm agent to ensure you’re fully covered.

How Much Does State Farm Comprehensive Coverage Cost?

Now, let’s talk money. The cost of State Farm comprehensive coverage depends on several factors, including your location, driving history, vehicle type, and coverage limits. Generally speaking, it’s one of the more affordable add-ons to your insurance policy, often costing just a few dollars per month.

But here’s the kicker—while comprehensive coverage might seem like an extra expense, it can save you a ton of money in the long run. Think about it: if your car gets totaled by a falling tree, the cost of replacing it far outweighs the monthly premium for comprehensive coverage.

And don’t forget about discounts. State Farm offers a variety of discounts that can help lower your premium, such as safe driver discounts, multi-policy discounts, and even discounts for bundling your home and auto insurance.

Factors That Affect Your Comprehensive Coverage Cost

So, what exactly impacts how much you pay for comprehensive coverage? Here are some of the main factors:

- Your location (urban areas tend to have higher rates due to increased theft and vandalism)

- Your driving record (fewer accidents and tickets mean lower premiums)

- The age and value of your vehicle (newer, more expensive cars usually cost more to insure)

- Your deductible amount (a higher deductible means lower premiums)

It’s like a puzzle, and each piece plays a role in determining your final cost. But with the right guidance from your State Farm agent, you can find the perfect balance between coverage and affordability.

How to File a Comprehensive Coverage Claim with State Farm

Okay, so let’s say the worst happens—your car gets damaged in a covered incident. What do you do? Filing a comprehensive coverage claim with State Farm is actually pretty straightforward. Here’s how it works:

First, contact your State Farm agent or call the claims hotline as soon as possible. They’ll guide you through the process and provide you with a claim number. Next, a claims adjuster will assess the damage to your vehicle and determine the cost of repairs or replacement.

Once the assessment is complete, State Farm will issue a settlement based on the value of your vehicle and the terms of your policy. If you have a deductible, you’ll need to pay that amount before the remaining costs are covered.

And here’s a pro tip—keep detailed records of any communication with State Farm regarding your claim. This can come in handy if there are any discrepancies or questions down the line.

Tips for Making the Claims Process Smoother

While no one likes dealing with insurance claims, there are a few things you can do to make the process smoother:

- Document everything—take photos of the damage and keep receipts for any related expenses.

- Communicate openly and honestly with your State Farm agent and claims adjuster.

- Respond promptly to any requests for information or documentation.

By staying organized and proactive, you can help ensure a quicker and more efficient claims process.

Is Comprehensive Coverage Worth It?

Here’s the million-dollar question—is State Farm comprehensive coverage worth the investment? For many drivers, the answer is a resounding yes. Consider this—if you drive an older vehicle with low market value, comprehensive coverage might not be necessary. However, if you’ve got a newer car or live in an area prone to natural disasters, it’s definitely worth considering.

Think of it this way—comprehensive coverage is like an investment in your peace of mind. It gives you the confidence to hit the road knowing that you’re protected against the unexpected. And in today’s world, who couldn’t use a little extra security?

Plus, with State Farm’s reputation for customer service and claims handling, you can trust that they’ve got your back when you need them most.

Common Misconceptions About Comprehensive Coverage

Before we wrap things up, let’s clear up a few common misconceptions about comprehensive coverage:

- Comprehensive coverage doesn’t cover collision-related damages—that’s what collision coverage is for.

- It’s not mandatory in most states, but it’s often required by lenders if you have a car loan or lease.

- Your deductible amount can significantly impact your out-of-pocket costs, so choose wisely.

Understanding these nuances can help you make more informed decisions about your insurance needs.

Final Thoughts: Is State Farm Comprehensive Coverage Right for You?

So, there you have it—the lowdown on State Farm comprehensive coverage. Whether you’re a seasoned driver or just starting out, this coverage can provide valuable protection for your vehicle. By understanding what it covers, how it works, and how much it costs, you can make an informed decision about whether it’s right for you.

And remember, when it comes to insurance, you’re not alone. State Farm agents are there to help you navigate the process and find the best coverage options for your unique situation. So why not give them a call and see how they can help protect what matters most?

So, what are you waiting for? Take the first step toward securing your vehicle’s future today. Your car—and your wallet—will thank you for it!

- Communism Vs Marxism A Deep Dive Into The Core Differences

- Bathazar Getty A Closer Look At The Iconic Heirs Life Style And Influence

Page 2 of 10 Finance People for your Finance

State Farm Car Insurance Review Coverage, Costs, and Trustworthiness

State Farm Insurance Card Template